The Greatest Guide To Short Term Loan

Table of ContentsThe smart Trick of Short Term Loan That Nobody is Talking AboutHow Short Term Loan can Save You Time, Stress, and Money.A Biased View of Short Term LoanShort Term Loan Can Be Fun For AnyoneThe 45-Second Trick For Short Term LoanThe Facts About Short Term Loan Revealed

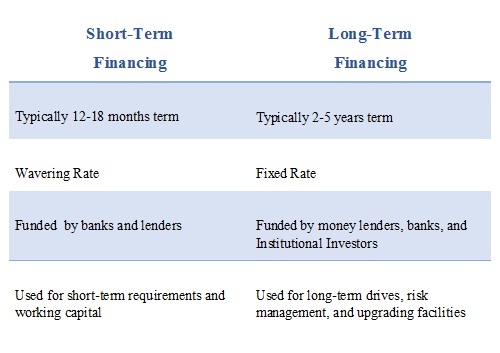

In circumstances like these, numerous people count on short-term fundings or brief term financing as a method to pay for unforeseen or hard individual expenses. Temporary financing is a car loan alternative that offers the recipient obtained funds for short-term expenditures, similar to just how a short-term lending functions!.?.!? Short-term fundings offer you obtained resources that you pay back, plus rate of interest, generally within a year or less.A massive advantage of short term funding is that they can make a large difference for people that require immediate accessibility to cash they don't have. Short-term lending lending institutions do not place a huge focus on your credit scores background for authorization. More crucial is evidence of work and a constant income, information regarding your financial institution account, and proving that you do not have any outstanding financings.

Several types of short-term fundings deal remarkable versatility, which is practical if cash money is limited now yet you anticipate things obtaining better economically soon. Before signing for your short term funding, you as well as the lending institution will certainly make a timetable for settlements as well as consent to the rates of interest up front.

The Only Guide for Short Term Loan

The benefit of temporary financing is that you get a reasonably little amount of cash right now, and you pay it back promptly (Short term loan). The overall interest paid off will generally be a lot less than on a larger, lasting loan that has even more time for rate of interest to develop. No monetary service is best for each borrower.

This is why it is very important to consider your alternatives in order to set on your own up for success. Take a look at the 3 top downsides of getting a short-term funding. The biggest disadvantage to a temporary car loan is the rates of interest, which is higheroften a great deal higherthan rate of interest for longer-term finances.

Short Term Loan Things To Know Before You Get This

On top of paying back the temporary lending balance, the rate of interest repayments can cause greater repayments each month (Short term loan). Nevertheless, bear in mind that with a short-term finance, you'll be repaying the loan provider within a short period of timewhich means you'll be paying the high interest for a shorter time than with a lasting lending.

Lasting lendings may have reduced passion rates, but you'll be paying them over several years. So, depending on your terms, a temporary finance might actually be cheaper in the future. While settling a brief term car loan on schedule according to your agreed upon timetable can be a substantial boost to your credit history, falling short to do so can trigger it to drop.

This can be damaging if you just have a little or good credit report, as well as ruining to your future potential to obtain if you currently have poor credit rating. Prior to taking out a short term loan, be truthful with on your own about your capability and also discipline when it pertains to repaying the loan in a timely manner.

An Unbiased View of Short Term Loan

There are several benefits and also disadvantages of short-term financing. Considering the top benefits as well as negative aspects of short-term fundings will certainly assist you make a decision if this economic device is ideal for your circumstance. If you Our site have anymore questions, make sure to speak to Power Money Texas today!.

? .!!. A temporary financing is a car loan check my blog that the customer needs to repay, in addition to passion, in a reasonably short period, usually in a year. The consumer returns the quantity of the funding to the loan provider over the program of months rather than years. If you remain in urgent need of funds to fund a purchase, you can easily request a finance either online or with a financial institution or credit union.

The needs for requesting a financing are: The consumer must be 18 years or above Legitimate e-mail address as well as contact number Although these are some of the demands that you might need to meet prior to requesting a finance, you don't need to have security while using for a financing.

The Ultimate Guide To Short Term Loan

There are several advantages linked with temporary car loans. So, let's discuss them to assist you comprehend exactly how valuable these loans can be. The sooner you have to return the funding, the quicker you can obtain them. Yes, this is the significant benefit important source that a customer gets from short-term lendings. If you are in immediate demand of cash, this is useful since the financing might be authorized in a shorter period.

As you are applying for a short-term financing, you should be positive adequate to repay it in the needed duration. Customers of short-term fundings usually acquire lines of debt.

The 10-Second Trick For Short Term Loan

Many lending institutions run internet sites that you can see straight to apply for a lending quickly. Offered that you have to pay off the funding within a short duration, the anxiety associated with settling it will certainly not last for long!

You can simply request a financing and repay it as quickly as you gain sufficient profit.

Comments on “The 4-Minute Rule for Short Term Loan”